Success Stories

A Helping Hand for a Frontline Health Care Worker

“They were kind and understanding, without losing a sense of professionalism. They took the time to review my application and looked at my payment history and not just at my credit score.”

ELENA

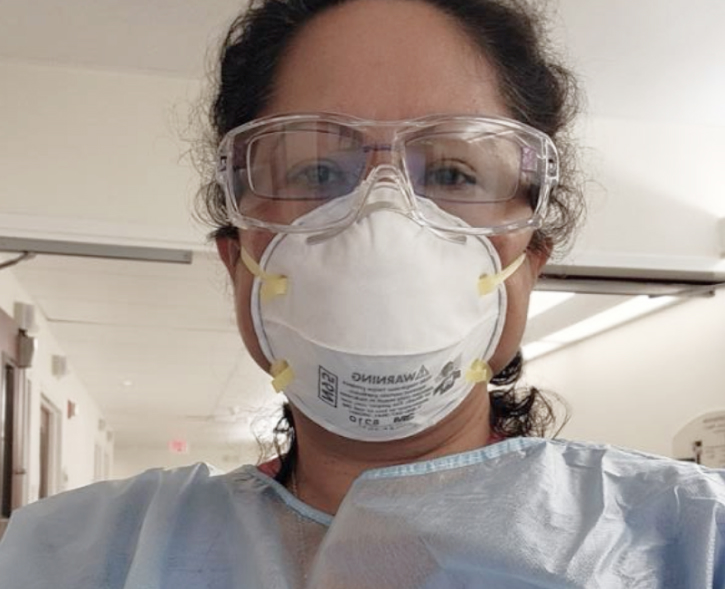

Elena is what’s known as a floating nurse. Instead of working every day at the same location, she travels to intensive care units in hospitals across Los Angeles County to fill in whenever they are short-staffed. It’s a demanding role, but Elena enjoys facing the new challenges it never fails to present from one day to the next.

During the height of the COVID-19 pandemic, those challenges were almost overwhelming.

Several nurses that Elena knew had died from the virus. Each day she was called on to don a full hazmat suit and to care for critically ill and dying patients who were required to remain isolated and were denied the comforting presence of family and friends at their bedside. Despite the risk to her own health, Elena continued to work 80 hours a week and never hesitated to do what she knew she had to do. “I couldn’t be afraid,” she says. “I had to be their family. I had to go into their rooms and hold their hands.”

At the same time Elena was doing everything she could to care for her COVID patients, she was facing challenges away from work. A single mom, she was struggling to make ends meet and had taken out a loan from a lender that marketed its services to health care professionals. Elena soon found that her loan’s 35 percent interest rate and hidden fees made it difficult for her to manage the monthly payments. When she asked to have her payments deferred or her debt refinanced, the lender, despite the surging pandemic, refused.

Now facing serious financial problems, Elena applied for loans from other lenders. Although she had never missed a credit card or loan payment, her credit score had fallen because she had co-signed auto loans to help her children buy cars so they could drive to their jobs. The lenders looked no further than her credit score and rejected her applications.

But then, during a long sleepless night, Elena found an online ad for the Economic Justice Fund. Her hopes rekindled, she submitted a loan application immediately and received a prompt response promising to review her application and get back to her.

And EJF did just that. A loan officer soon called and, much to Elena’s surprise, was willing to talk with her about her application and the factors affecting her credit score. Together, she and the loan officer explored her options for an EJF personal loan. Eventually, after taking into consideration Elena’s character, employment history, and service to the community during the pandemic as well as her credit score and financial circumstances, EJF approved a loan for her that offered a low, fixed interest rate and monthly payments that she could afford.

The loan enabled Elena to pay off the predatory loan she had taken out and to save $300 each month in interest payments. As her finances continued to improve, she began dreaming of someday launching a business to train aspiring nurses. She is grateful to the Economic Justice Fund for the personalized service she received.