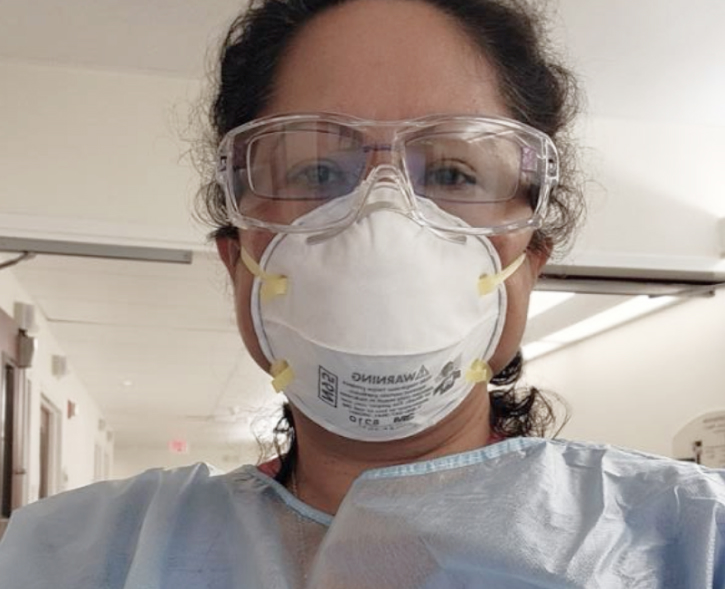

Featured Success Story

A Helping Hand for a Frontline Health Care Worker

“They were kind and understanding, without losing a sense of professionalism. They took the time to review my application and looked at my payment history and not just at my credit score.” - Elena

Read Story All Stories