Success Stories

Helping a Single Mother Invest in Transportation

“I remember feeling like a prayer was answered. I really appreciate the work that the Economic Justice Fund is doing.”

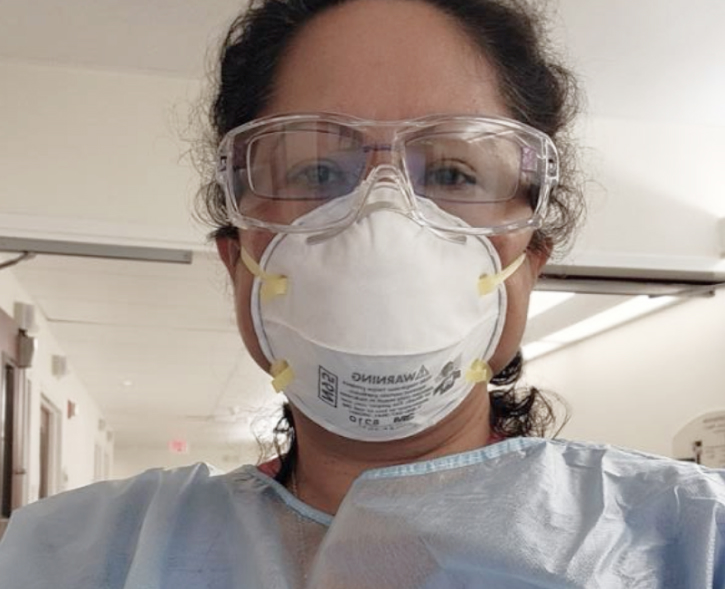

CRTSTAL

In 2021, Crystal, a Los Angeles-based professional, found herself without a car due to several factors out of her control.

“I’m a single mom of four,” she says. “That means four drop-offs every morning before I even get to work.”

For several months, she had to rely on carefully planned Uber rides to ensure everyone in her family could get around.

“And that was extremely challenging,” she explains. “I had to get everyone there at essentially the same time, which doesn’t work on public transportation. And if you know Uber, sometimes they cancel at the last minute, so my children would just be outside waiting, but their ride wasn’t coming.”

Due to a predatory loan with a high interest rate and fees, she was in a “vicious cycle” that made it difficult to save and buy a new car.

“You can’t really save enough to get something else because you need to survive,” she says.

She searched for a personal loan to help pay for a vehicle.

A breakthrough

Crystal discovered the Economic Justice Fund (EJF) during one late-night Google search. She wondered if the nonprofit financial institution was the real deal.

Crystal started researching the EJF and reading client reviews and decided to apply. After what she calls a simple application process, EJF approved her for a personal loan in late 2021 and provided another in April 2022 due to her perfect payment history.

“I remember feeling like a prayer was answered,” she says. “I really appreciate the work that the Economic Justice Fund is doing.”

It’s easy to get sucked into a downward spiral

Even earning a fair salary, Crystal says getting approved for traditional loans can still be challenging.

“For people who don’t have exceptional credit or a lot of credit history, it’s really hard to find loans, no matter what your salary is,” she says. “And when you’re searching for money, people will apply anywhere if it’s a desperate situation.”

Before finding EJF, she conducted Google searches for short-term loans and even payday loans.

Which is obviously not enough to get a car,” she says. “Those are easier to get, but I needed something a little more substantial.”

After applying to several lenders, it also began to negatively affect her credit report, which made it difficult to get approved by other loan companies.

Enjoying newfound freedom

After receiving loans from EJF, Crystal could finally purchase a car for her family. The vehicle not only allows her to transport her children to school safely, but it also enables her to visit loved ones who live 30 miles away from her home.

“I have the ability to see my family now, visit my mom, who is older, and help out my cousins,” she says. “A car is really a symbol of freedom of having the ability to move around. It’s the ability to earn income, get your kids to school, and get to work.”

Crystal’s financial well-being has continued to strengthen. Her oldest daughter recently started driving, and Crystal has generously purchased a second car for her family.