Affordable low-interest loans

⏱️ Pre-Qualify In One Minute

✅ Applying Won’t Impact Your Credit²

🚫 No Hidden Fees!

Scroll down

Apply online.

Won't affect your credit²

Get our decision.

Review your options

Get your money fast!

Next day funds*

A personal LOAN for any of your financial goals

Borrow from $2,500 to $25,000, and you can use the money in a variety of ways.

debt consolidation

Pay off high-interest credit cards or loans and consolidate payments into one, low-interest rate loan.

Emergency Expenses

We understand that emergencies happen, and we’re here to help during your time of need.

credit building loans

Affordable loans that empower borrowers to establish and build a positive credit history.

Home or Auto Repair

Cover unexpected repairs or bills with a low interest rate loan.

Medical or dental expenses

Pay an unexpected bill for health care costs for you or your family.

something else

Use funds for a wide range of purposes. We offer flexible loans to support you.

Fair. Affordable. Flexible.

Our loans offer affordable low-interest options and have no fees!

Fast funding

We deposit the funds to your account on the next business day after we approve your loan.

Low, fixed interest rates

The low rate is fixed for the life of the loan, so your rate and monthly payment never change.

No fees

You pay no application fees, no origination fees, no servicing fees, and no prepayment fees. There are no hidden fees!

Easy Automatic Payments

We can set up one monthly payment for you that occurs automatically on the same day every month.

Flexible terms

Loan terms range from 12 to 60 months. We work with you to determine an affordable repayment plan.

Free credit building

We report your loan payments to the major credit bureaus to help you build your credit score.

Pre-Qualify for a Loan

You Can Pre-Qualify In Less Than One Minute. There’s No Impact On Your Credit Score.

start saving thousands with a low, fixed rate loan.

High-interest debt got you down? We’re here to help you pay off high-interest debt! We’ve got you covered!

See below how you can save thousands on interest payments with a loan from the Economic Justice Fund.³ Our low-interest options are affordable and fee-free. Let us help you get back on track with ease!

Loan amount

$10,000

$10,000

Interest rate

32%

9%

Origination fee

5%

0%

Amount deposited to you

$9,500

$10,000

Annual Percentage Rate (APR)

34.80%

9%

Term

60 months

60 months

Monthly payment

$335.93

$207.58

Total interest and fees

$10,155.53

$2,455.01

Total payments

$20,655.53

$12,455.01

$8,200.52

TOTAL SAVINGS!

what our borrowers say

Our mission is simple: make affordable, low-interest options accessible and charge no fees! We have earned a Five-Star Trustpilot Score Rating. Read verified reviews from our borrowers on Trustpilot.

We deliver financing solutions

The Economic Justice Fund is a mission-driven, nonprofit lender dedicated to helping Americans pursue the American Dream. We are certified as a Community Development Financial Institution by the U.S. Department of the Treasury.

Questions & Answers

You must be a U.S. citizen, permanent resident, or visa holder and 18 years old or older. Our loans are currently available only to borrowers living in California.

- You must have a FICO Credit Score above 660 to prequalify to be eligible to apply for a loan.

- IMPORTANT: If you do not know your FICO Credit Score, you should obtain a free credit report from AnnualCreditReport.com before applying. This is the only website the federal government authorizes to issue free annual credit reports.

- Your credit report must show no accounts in open collections.

- Your credit report must show no defaults on personal loans or credit cards in the last four years and no repossession, bankruptcy, or foreclosure in the previous seven years.

- You must be employed or self-employed and have documentation of monthly income.

Federal law gives you the right to get a free report once every 12 months from each of the three nationwide consumer credit reporting companies through AnnualCreditReport.com. You can request all three of your reports at once, or you can space them out over the course of the year. AnnualCreditReport.com is the only official site to get your free annual credit reports. This right is guaranteed by Federal law. You can verify that AnnualCreditReport.com is the official site by visiting the Consumer Financial Protection Bureau (CFPB), a U.S. government agency that makes sure banks, lenders, and other financial companies treat you fairly.

Tip: Be cautious of websites that claim to offer free credit reports. Some of these websites will only give you a free report if you buy other products or services. Other websites give you a free report and then bill you for services you have to cancel. To get the free credit report authorized by Federal law, go to AnnualCreditReport.com

The funds from our loans are commonly used for debt consolidation, credit card consolidation, credit building, emergency or unexpected expenses, moving costs, home repairs or improvements, and medical or dental expenses.

We offer loans ranging from $2,500 – $25,000.

The Economic Justice Fund verifies all requirements by checking information on your credit reports. You may only attempt to prequalify once every 12 months, so please first confirm that you meet all Eligibility Criteria and Pre-qualification Requirements before proceeding. We perform a soft credit inquiry when you complete the pre-qualification form. This won’t impact your credit score. Soft credit inquiries do not appear on your credit report and do not affect your credit score. We will perform a hard credit inquiry only after you accept a loan offer.

Loan funds are transferred on the next business day if the loan agreement is completed before 5 pm PT Monday-Friday, excluding holidays. If the loan agreement is completed after 5 pm PT, on a weekend, or on a holiday, the funds will be transferred on the following business day.

The Economic Justice Fund charges no fees. Many other lenders charge application fees, origination fees, servicing fees, and prepayment fees. We charge no fees because we believe in providing fair and affordable loans with transparent terms. You pay no fees.

There are no application fees, no origination fees, no servicing fees, and no prepayment fees. There are no hidden fees!

We provide low, fixed interest rates based on various factors including an applicant’s employment and payment history, income, and credit report. The fixed interest rates are as low as 9.9%.

We offer flexible loan terms ranging from 3 – 7 years for monthly payments that fit your budget with an affordable repayment option. We will work with you to determine the term that is appropriate for you.

You are welcome to repay the loan early without a prepayment penalty or fee.

We charge no prepayment penalties or payoff fees.

Our prequalification decisions are provided immediately, and full applications are typically approved the same business day.

APR is used to show the total cost of a loan by including the interest rate and all fees. APR represents an accurate cost of borrowing and can be used to compare annual loan costs across different loan options. Since the Economic Justice Fund charges no fees, the APR will always match your low interest rate on the loan, from 9.99% to 29.99%. Therefore, the maximum APR on the Economic Justice Personal Loan is 29.99%.

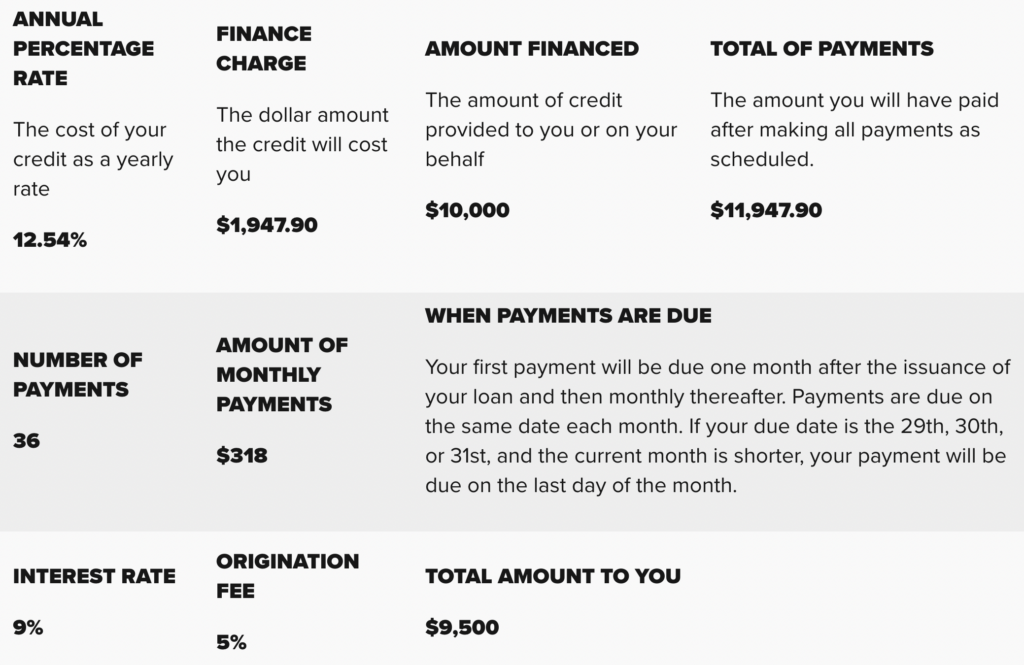

If you had a $10,000 loan with a 9% interest rate and 5% origination fee, the APR would be 12.54% over the 36-month term. Below is a real-life example of this $10,000 loan that explains the rates and fees. Since the Economic Justice Fund charges no fees, the APR will always match your low interest rate on the loan.

The Economic Justice Fund is certified by the U.S. Treasury Department as a Community Development Financial Institution. California loans will be made or arranged pursuant to the Department of Financial Protection and Innovation (Finance Lenders License #6089475). All loan applications are subject to credit approval. Pricing and terms are subject to change.

*Loan funds are transferred on the next business day if the loan agreement is completed before 5 pm PT Monday-Friday excluding holidays. If the loan agreement is completed after 5 pm PT, on a weekend, or on a holiday, the funds will be transferred on the following business day.

¹ If approved the actual loan amount, term, and interest rate limit may vary based on credit determination and state law. Minimum loan amounts and interest rate levels vary by state. The decision process may take longer if additional documents are needed or requested. Approval and loan terms will vary based on credit determination and state law. Not all applicants will qualify for their requested loan amounts or most favorable loan rates and terms. All unsecured personal loans through the Economic Justice Fund offer a fixed rate and range between 9.99% – 35.99% APR. Your APR will be determined based on your credit, income, and certain other information provided in your loan application. Not all applicants will be approved. Not all borrowers receive the lowest rate. The lowest rates are reserved for the most creditworthy borrowers.

² To check the rates and terms you may qualify for, the Economic Justice Fund conducts a soft credit inquiry that will not affect your credit score. If you accept a loan offer, we may conduct a hard credit inquiry that may impact your credit score. If you take out a loan, repayment information may be reported to the credit bureaus.

³ Example chart shows calculations based on a 60-month Economic Justice Fund loan with a fixed interest rate of 9%. The lowest rates are reserved for the most qualified borrowers. The High-Interest Rate Loan in the chart is only a representative example.